0) Obama Win the election

1) According to the ADP national employment report, nonfarm private employment declined by 157,000 in October, which is the largest decline since 2002. The result was worse than the expected drop of 100,000. September was revised to a decrease of 26,000 from a decrease of 8,000. The ADP data have had a spotty track record compared to the government's report, which includes both public and private nonfarm payrolls, and is set for release on Friday.

2) The services sector contracted by the most since at least 1997 and the sixth time this year, according Institute for Supply Management's national nonmanufacturing survey, which dates back to 1997. Specifically, the October ISM Services Index registered 44.4 in October, 2.6 worse than expected and 5.8 lower than the 50.2 reading in September. A reading below 50 is intended to imply contraction in the services sector.

3) Goldman reduce bonus, begin 10% jobcut, that is about 3200.

===================================

Ok, let's look at the stock market

Let's look at last 2 month of DOW.

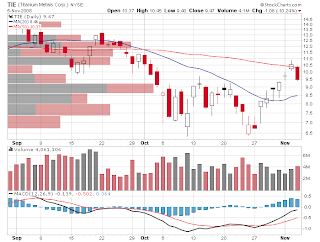

2. TIE Play

TIE up from $7 to $10.8 yesterday. Up 50%. I have 4% trailing stop set yesterday. It was trigger around $10.42. The low is 10.3 and closing is 10.55.

By the end of the day, I have no idea if it should go up or down. But since it is up 50%, also 10.62 is the 61.8% retracement from previous high of 13.2 to previous low of 6.5. Probably a high probability to tight the profit taking stop.

Look at the 2 month chart. The next visual support is around 8.5 - 9.0 area. Today, it close at 9.47.

From 10day chart, 8.5 is a good support. volumn by price is high around that area. Also, 10day low is 6.5, high 10.8, 50% retrace level is 8.65. 61.8% is around 9.15. So if break 9, we probably can buy some around $8.5? Or should we back to $7 area?

No comments:

Post a Comment